About

Traditional financial planning has failed first-time homebuyers.

Why Did We Make GetWyz?

Too often buying a home is a maze of confusing timelines, shifting interest rates, credit uncertainty, and endless “where do I even start?” moments.

We created GetWyz because we believe every future homeowner deserves clarity, confidence, and a personalized path to their own HomeOwner Day.

GetWyz

[ɡɛt • waɪz] Resource

A guide that helps first-time homebuyers plan their exact “HomeOwner Day” through personalized timelines, smart credit insights, and actionable milestones.

Instead of scattered advice and generic calculators, we bring together your financial reality, market data, and step-by-step guidance into one clear roadmap.

Our mission is simple: to take the guesswork out of homebuying so you can stop stressing about what’s next and get excited about the moment you finally get the keys in your hand.

The HomeOwnership Planning Gap

Traditional financial planning platforms don't treat homeownership as a planning service, leaving millions of Americans guessing about one of the biggest financial decisions they'll ever make.

38

years old is the median first-time homebuyer age (vs. 28 in the 1980s).

83%

of renters want to buy, but don’t know when they will be ready to

3.2

average years from “thinking about” to actually buying a home

clear, actionable path to homeownership.

When the plan is clear, the waiting stops. GetWyz gives individual homebuyers access to the kind of financial planning institutions rely on. Thoughtful, precise, and built to move you forward.

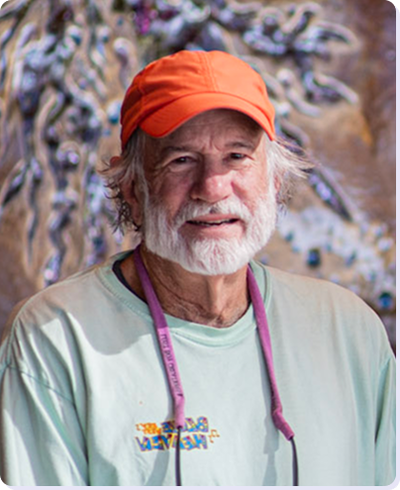

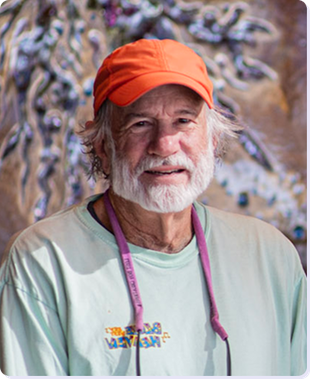

Message From the Founder

GetWyz treats homeownership like real financial planning - because that's what it is.

I've spent the last 20 years building financial planning software. After founding MoneyGuide and working with thousands of financial advisors, I discovered something shocking: nobody was properly planning for homeownership.

Traditional financial planning treats buying a home like any other goal - save X amount, then buy. But homeownership is different. It involves credit scores, debt-to-income ratios, market timing, loan programs, and dozens of other factors that change your timeline completely.

When I looked at what was available to consumers, I found generic tools that ignored the complexity of real financial situations. People are waiting because they don't know when they'll be ready. That gap is exactly why I created GetWyz: to replace uncertainty with a clear, personalized path that tells people when homeownership is realistic and how to get there faster.

Our Team

Our team brings together decades of experience across financial planning, mortgage lending, and technology. United by a shared belief that every aspiring homeowner deserves the same quality guidance that was once reserved for the wealthy.

Core Business & Strategy

20+ years building financial planning software used by thousands of advisors nationwide.

Finance & Planning

Deep expertise in the metrics that actually determine when you're ready to buy.

Banking & Mortgage

Real-world lending experience across loan programs, underwriting, and approval processes.

Software Development

Building secure, scalable tools designed for complex financial calculations.

Product & Design

Turning complicated homebuying data into clear, actionable guidance.

Security & Legal

Protecting your financial information with institutional-grade standards.